Introduction

E-invoicing is rapidly becoming the standard for businesses across Europe and beyond. Unlike PDFs or paper invoices, e-invoices are structured digital documents that can be automatically processed by accounting and tax systems, reducing manual work and ensuring compliance. With the EU’s upcoming VAT in the Digital Age (ViDA) initiative, e-invoicing will become increasingly relevant and, in the future, mandatory on a State-by-State basis and subsequently across all the EU. In this guide, we’ll explain what e-invoices are, why they matter, and how you can create e-invoices using Harvest - including technical features that allow integration with the Peppol network.

What is an e-invoice?

An e-invoice (electronic invoice) is a digital version of a traditional paper invoice that is created, sent, and received in a structured electronic format. Unlike a PDF or scanned document, an e-invoice is generated in a standardized format - XML in the case of Harvest - that can be automatically read and processed by accounting or enterprise systems.

Because e-invoices are designed solely for computer systems to interpret, they are not intended to be read by people. For this reason, they are usually accompanied by a more human-friendly version (such as a PDF or on-screen display) so the recipient can review details easily.

This automation reduces manual work, lowers the risk of errors, and speeds up payment cycles; many governments and businesses also require e-invoicing to ensure tax compliance, improve transparency, and streamline financial operations.

Why are e-invoices increasingly relevant?

The EU is moving toward an increase in the usage of e-invoicing under its “VAT in the Digital Age” (ViDA) initiative, adopted in 2025, which aims to modernize and digitalize how VAT is reported and monitored.

The aim is to reduce fraud and close the VAT gap by ensuring transactions are recorded in real time through standardized, machine-readable invoices. Beyond fighting tax evasion, e-invoicing will make cross-border trade simpler and more transparent, cutting paperwork and lowering compliance costs for businesses. From July 2030, all intra-EU B2B transactions will need to use this system, creating a more efficient and consistent approach to VAT across Europe. However, each affected country has its own additional regulations, and national authorities are setting different timelines for compliance. Businesses will therefore need to keep track of both EU-wide rules and their local leglisation, as select countries have already begun rolling out new requirements.

The EU Commission's general requirements

Creating e-invoices through Harvest

Transitioning to e-invoicing can be rather confusing given the technical complexity, but Harvest can get you on the right path! With only a few extra information fields required, Harvest can produce UBL e-invoices ready for you to export to clients at will.

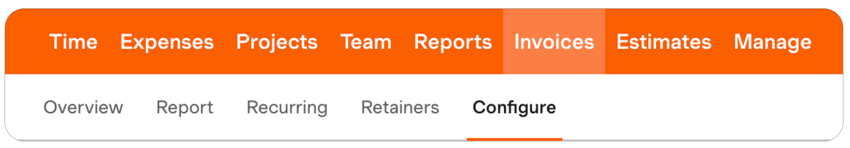

To enable e-invoicing through Harvest, access the Configure page within Invoices. There you will see a field to turn on e-invoicing.

Once you have the field, we'll need you to add some further information. Your VAT number, company name, contact details and address are all required to produce e-invoices, with additional fields as optional.

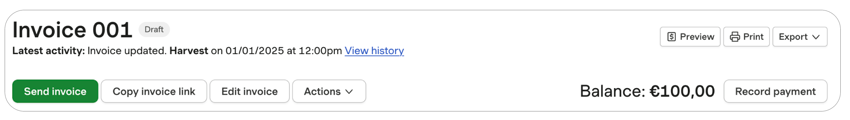

When you've finished saving your company information, you'll be free to start exporting your invoices in UBL format. If you wish to simply save the e-invoice to your device, you can do so by clicking the Export drop-down for an invoice draft.

Alternatively, if you want to attach the e-invoice to an email alongside a PDF, you can do so by clicking Send invoice.

Whichever export format you choose, we'll finish off by prompting you to double check your company information, input the same details for your client, and then your e-invoice will be downloaded to your device.

What is Peppol?

The Peppol network (Pan-European Public Procurement Online) is a secure, standardized system that allows businesses and public authorities to exchange electronic documents, such as e-invoices, across borders. Instead of relying on fragmented national platforms, Peppol provides a common infrastructure where organizations connect through accredited access points, ensuring compatibility and trust. As part of the EU’s move to mandatory e-invoicing, several countries are requiring the use of Peppol - or a similar certified network - to send and receive invoices. This ensures that invoices can flow seamlessly between different systems while meeting both EU and national compliance requirements.

How Harvest can help you send e-invoices through Peppol

Remember those optional fields we mentioned when enabling e-invoicing in Harvest? We've added these fields to cater for users who are required to send their e-invoices through the Peppol network, or similar alternatives.

While Harvest itself is not a Peppol gateway, Harvest can help you to prepare e-invoices to send through an external Peppol gateway.

If you are unsure where to find a Peppol gateway, you can read more about them here.

Get started e-invoicing with Harvest!

Start simplifying your invoicing today. Try Harvest for free to send invoices in UBL format.

Please note that you are solely responsible for ensuring that invoice exports comply with any applicable e-invoicing requirements. As Harvest accepts no liability for any non-compliance, you are responsible of checking and ensuring compliance of the e-invoices generated through Harvest. Nothing in this page should be interpreted as an assumption of liability or a representation or warranty by Harvest regarding the content of this page. In case you have doubts regarding the applicability of regulatory or compliance obligation to you or your business, you should reach out to a tax or legal specialist.